Category Archives: Malaysia

Malaysia – Iskandar follows the Shenzhen script

Iskandar follows the Shenzhen script

http://www.scmp.com/business/money/markets-investing/article/1257278/iskandar-follows-shenzhen-script

Links to Hong Kong are replicated in the Malaysian economic zone’s ties to Singapore

Efforts to transform the Malaysian border zone near Singapore into a bustling commercial corridor appear to be on track after a rocky start.

The zone, known as Iskandar, is emerging as an attractive opportunity that deserves to be on the radar of those considering investment in the new growth centres of Asia.

Iskandar is a 2,216 square kilometre urbanisation project, three times the size of Singapore. Nusajaya, the residential zone at its core, which stares across the water at the Singapore skyline, is just a 45-minute drive from Singapore’s Changi airport. The zone is geared towards a residential metropolis with educational, medical and theme-park infrastructures being used to attract resident migrants from Singapore. Logistics, transport and industrial-related infrastructure is being developed in adjacent zones.

Iskandar is a 2,216 square kilometre urbanisation project, three times the size of Singapore. Nusajaya, the residential zone at its core, which stares across the water at the Singapore skyline, is just a 45-minute drive from Singapore’s Changi airport. The zone is geared towards a residential metropolis with educational, medical and theme-park infrastructures being used to attract resident migrants from Singapore. Logistics, transport and industrial-related infrastructure is being developed in adjacent zones.

One reason that Iskandar makes investment sense is that it complements Singapore’s new economic strategy. The city state’s sharp rise in housing prices and schooling costs is creating a natural pool of demand for low-cost living within commuting distance. This pool also includes the growing ranks of Singaporean pensioners struggling to survive in a low-yield and high-inflation environment. Iskandar’s new industrial parks offer the lure of cheap labour, good logistics and infrastructure. For Malaysia, it offers the possibility of regenerating the neighbouring border city of Johor Bahru, improving cross-border connectivity and bringing in cross-border investment in a golden era of Malaysian-Singaporean relations.

Malaysian planners borrowed heavily from China’s experience in fostering rapid industrialisation of the Pearl River Delta economic zone. Authorities in Kuala Lumpur identified the Johor border zone in 2006 as one of Malaysia’s five special economic corridors, reminiscent of the way Shenzhen was singled out as one of China’s five special economic zones in 1979.

However, it has only been since 2011, when Singapore’s sovereign fund Temasek announced a 30 billion Malaysian ringgit (HK$6.33 billion) joint investment with its Malaysian counterpart Khazanah that overseas investors started taking Iskandar seriously.

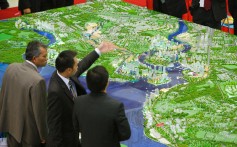

Businessmen have closely followed the plans for Iskandar as it broadens its appeal to investors. Photo: Bloomberg

For overseas investors, the key attraction of Nusajaya’s residential real estate is low prices. Malaysia remains the only market in Asia outside Hong Kong and Singapore to allow foreigners to own freehold property without restrictions. Consider also that Singaporean property prices have risen by close to 50 per cent during the past five years and have been the target of numerous government measures to restrain further price appreciation. Keep in mind that average property prices in Singapore are 3.7 times more expensive than Nusajaya’s. Much like Shenzhen over a decade ago, it is this cross-border price arbitrage that will continue to fuel strong home-price appreciation in Iskandar. Indeed, with prices already at 750 Malaysian ringgit per square foot, Iskandar property is comparable with prices in the capital Kuala Lumpur. That said, cross-border connectivity plans are likely to be a catalyst for future gains in land prices.

Currently, there is one coastal highway connecting Singapore to Nusajaya across the Johor strait at two gateways: the Causeway and the Second Link. A new ferry link between Singapore and Puteri Harbour, Nusajaya, began service in May. Future plans include an MRT link to Singapore’s MRT system and a high-speed rail service from Kuala Lumpur to Johor Bahru which will connect to central Singapore.

Iskandar’s success in attracting big-brand investors, especially from Britain, has been surprising and possibly reflects strong government involvement. The Legoland theme park, which opened in September last year, attracted 1 million visitors in just four months. It has since had to introduce admission caps to cope with the flood of daily visitors. The Hello Kitty Town park opened one month later has also enjoyed strong visitor growth.

More surprising has been the success of Educity, a campus of schools and colleges which has filled up so fast that authorities have decided to develop an adjacent Education Park. Southampton University and Newcastle University have both opened faculties and currently have several hundred students enrolled

Britain’s Marlborough College has also established an integrated primary and secondary boarding school in Educity. About 370 students, many commuting daily from Singapore, are currently enrolled. Other high-profile brands soon to open include Singapore’s highly-regarded Gleneagles Hospital, which will open a 300-bed medical centre by next year.

The “build it and they will come” model of investment has yielded impressive results both in Singapore and in markets such as Macau. The synergies between Iskandar and Singapore, including joint government financial commitment to ensure its success, add up to a good long-term investment for those looking to relive the heyday and investment returns of Hong Kong’s economic integration with Shenzhen.

Carl Berrisford is an analyst for UBS CIO Wealth Management

Related articles

- More snapping up homes in Iskandar M’sia (iskandarmalaysiaproperties.wordpress.com)

Malaysia Johor – 3rd link to Singapore

New ferry connection to create 3rd link to Singapore

Posted on December 19, 2012 – Property News.

Marina at Puteri Harbour

Marina at Puteri Harbour

A new customs, immigration and quarantine (CIQ) complex and ferry terminal is currently being completed in Puteri Harbour, in the Iskandar region of Johor. This complex will serve ferries which will ply between Puteri Harbour and Singapore.

UEM Land Holdings CEO Dato’ Wan Abdullah Wan Ibrahim referred to this complex at the recent “Living Nusajaya” media tour: “The ferry terminal will be completed [by mid-January] but it’s got to be fitted and our new CIQ complex has got to be occupied by the Malaysian Customs and Immigration department.”

“We’ve just about appointed the operator for this terminal. The operator is now making his leads to all the various ferry operators. You can expect that by the end of…

http://www.starproperty.my/index.php/property-news/new-ferry-connection-to-create-3rd-link-to-singapore/

Malaysia – A new era in governance in Iskandar Malaysia

By Khalil Adis

The recently concluded Malaysian general election was one that was closely watched and had both Malaysians and Singaporean on the edge of their seats.

With a more savvy generation emboldened by social media and a strong desire for change, the 13thgeneral election saw opposition parties fighting tooth and nail alongside the ruling Barisan Nasional (BN) party as Malaysians far and wide call for a more transparent government

Even states with a strong base of UMNO supporters like Johor witnessed the opposition gaining ground with the fall of Chief Minister Abdul Ghani Othman’s seat in Gelang Patah to the Democratic Action Party’s (DAP) Lim Kit Siang.

Read more: http://sg.news.yahoo.com/blogs/property-blog/era-governance-iskandar-malaysia-141223924.html

Related articles

- Iskandar drew RM5b investments in Q1 2013 (investjohor.wordpress.com)

- Iskandar Malaysia to Stay Competitive despite election outcome (investjohor.wordpress.com)

- Johor to stay competitive (singmalayproperty.wordpress.com)

Malaysia – Maybank expands overseas property loan scheme

Maybank expands overseas property loan scheme

sunbiz@thesundaily.com

PETALING JAYA (May 28, 2013): Malayan Banking Bhd (Maybank) is targeting to secure RM200 million in financing for properties in Sydney, Perth and Singapore this year, as it expands its overseas mortgage loan scheme to include purchases of residential properties in the three new markets.

Maybank deputy president and head of community financial services, Datuk Lim Hong Tat said since the scheme was launched in 2011, total financing secured has reached some RM720 million. Of this amount, over 90% has been for London properties while the balance has been for Melbourne purchases.

Read more: http://www.thesundaily.my/news/710778

Related articles

- Singaporean’s confidence in Iskandar at a new high (investjohor.wordpress.com)

- BN victory will be good for banking sector and economy: Maybank (nst.com.my)

Malaysia – Get real estate-tic

Income earners in their 20s are fast making their presence felt in the property market. But getting there takes discipline.

HE acquires one property a year. He has been doing this for the past five years. Today, at the age of 38, his one regret is that he didn’t start earlier, when he was in his 20s.

Entrepreneur JS dishes out advice that he himself takes seriously. He tells young people all the time that they should invest in property from a young age, or the money that could have gone into real estate would be frittered away.

An artist’s impression of Afiniti Residences in Medini Iskandar Malaysia. (Photo: Afiniti)

An artist’s impression of Afiniti Residences in Medini Iskandar Malaysia. (Photo: Afiniti)