Monthly Archives: June 2013

Thailand – Confidence in condos

Confidence in condos

Tony Liaw

Thursday, June 13, 2013

http://www.thestandard.com.hk/news_detail.asp?we_cat=16&art_id=134530&sid=39804827&con_type=3&d_str=&fc=7

|

Among southeast Asian nations, Thailand seems unable to attract a lot of foreign investors to its property market. And it’s probably due to some myths about Thai taxation, said Apichart Chutrakul, chief executive of property developer Sansiri.

Foreigners are technically prohibited from owing land in Thailand under their own names, he said.

“However, under the Condominium Act, 49 percent of the liveable square meterage of a condominium building can be owned by foreigners,” Apichart said.

“This enables people to purchase condominium units under their own name, without having to resort to registering a company in Thailand.”

And Sansiri, which specializes in selling condominiums, is eyeing overseas buyers.

“We have a solid marketing plan to increase the portion of foreign condo buyers from 3 percent to 10 percent within the next three to five years,” Apichart said.

In fact, Bangkok has seen its condo market grow rapidly over the past 25 years.

In 1998, the Thai capital had less than 10,000 units, currently there are more than 350,000 units, data by CB Richard Ellis show.

Prices have also gone up, rising to 23,225 (HK$5,822) baht per square foot from 3,250 baht psf 20 years ago.

Sansiri expects the stable demand for residential units to continue, particularly in the up-country market and holiday destinations such as Phuket, Pattaya and Chiang Mai.

“We expect a 14 percent increase in presales – from 42 billion baht in 2012 to 28 billion baht this year – as

|

a result of the expansion of the mass transit system, growing consumer confidence and a rising pace of urbanization amidst a low interest rate environment,” Apichart said.

He added that the condo segment has long-term market potential.

At the same time, Thailand’s central bank is staying alert over the possibility of an asset bubble, warning that any breakdown would badly hamper the already slow recovery from the global financial crisis.

“We need to be cautious and monitor the situation very closely, and prepare measures to cope with any possible problem,” Songtham Pinto, director of the Bank of Thailand’s macroeconomy division, told a property seminar recently.

But developers are taking a different view as large firms have dominated Thailand’s housing market and are capable of responding to risks in a timely manner.

The sector also warned that wrong measures – usually targeting short-term speculators – could greatly affect buyers.

As one of the largest developers, Sansiri is kicking off a roadshow for its latest project this weekend.

It is offering 206 residential units, with sizes of 640 to 2,830 sq ft, at its beachfront condo project Baan Mai Khao, Phuket. Prices range between HK$1.75 million and HK$13.25 million. The roadshow runs on Saturday and Sunday in Hong Kong, and July 6 and 7 in Singapore.

Related articles

- Thailand – Modest private luxury on Phuket (boomtownasia.wordpress.com)

- Hau Hin a Foreigners Retirement Paradise (chefleez.wordpress.com)

Asian Property Markets Starts To Cool

Asian Property Markets Starts To Cool

News Posted On: 13 June 2013

http://www.property-abroad.com/thailand/news-story/asian-property-markets-starts-to-cool-19317724/

Asia has seen it’s housing markets continuing to accelerate ahead of the becalmed European scene, but the rate of that acceleration has slowed as cooling measures take effect. Global research and real estate consulting firm CB Richard Ellis released a report showing that among 13 of Asia’s major cities, nine saw only modest price rises of between 0.7% and 3%.

Price growth was led by New Delhi and Mumbai, which saw gains of between 2% and 4% quarter on quarter, an effect attributed to tightening supply, while other strong performers included Manila in the Phillipines and Kuala Lumpur. Mild price growth was recorded in Beijing, Shanghai, Guangzhou and Shenzen.

In Bangkok, prices fell by 0.5% but this follows several quarters of steady increases and CBRE points out that the statistical impression of the market was distorted by a number of specific transactions. Outside of these, many projects in Bangkok are still seeing rising prices, again attributable to short supply.

Sales volumes, however, are declining across the region. Transaction numbers fell in Beijing, Shanghai, Guangzhou and Shenzen, and CBRE attributes these results to measures introduced by the Chinese government to cool the markets in these cities. Hong Kong and Singapore have introduced measures to cool their own markets, primarily in the form of increased stamp duty, and sales volume has slowed here too.

CBRE says concerns remain about the high cost of residential property in many markets. While the demand from end users and long term investors is expected to remain firm, cooling measures introduced in many of Asia’s markets have already begun to dampen buyer demand.

‘Overall house prices are set to hold steady or ease slightly over the next few quarters. The risk of rising inflation means authorities are likely to keep cooling policies in place or to introduce additional controls should prices continue to surge,’ CBRE states in its report. The company further expects that, as a result of regulatory cooling measures, ‘buyers will take longer to negotiate and conclude deals and are likely to become more selective in terms of the assets they acquire.’

This more cautious outlook from buyers has had some local benefits to the rental market. The CBRE Luxury Residential Rental index increased by 0.2% quarter-on-quarter in the first three months of 2013, compared to a 0.7% decline in the fourth quarter of 2012. Rents increased by between 0.5% and 1.8% in Beijing, Shenzen, Bangkok and Kuala Lumpur but were flat in Singapore and New Delhi.

The luxury residential market is expected to be subdued for some time in the region, according to CBRE. ‘Multinationals remain cost sensitive and weaker demand from expats will put downward pressure on rents over the remainder of the year despite the fact that there may be an uptick in demand from potential buyers priced out of the sales market,’ the company’s report explains.

It seems that the measures enacted to cool markets are having the opposite effects from those intended in some cases. In Hong Kong, concerns over the housing market originate with the plight of Hong Kong citizens unable to afford housing; yet cooling measures have coincided with rises in prices and little effect on rents. While the liquidity of the market is reduced, access to it, particularly for those on lower incomes, does not appear to have improved.

Written by Les Calvert Overeas Property Specialist

Hong Kong – Home prices to fall further, agents say

Home prices to fall further, agents say

Yvonne Liuyvonne.liu@scmp.com

Estate agents believe home prices in Hong Kong could drop a further 5 per cent in the second half of the year, bringing the total decline for 2013 to around 10 per cent.

“Prices have already dropped by 4.5 per cent from the market peak in February due to the introduction of new stamp duties,” said Midland Realty chief analyst Buggle Lau Ka-fai. “They could fall 5 to 10 per cent for the whole year.”

Sales are tracking prices downwards, and Midland has also revised its forecast on transaction volumes. Executive director Vincent Chan now believes some 53,000 flats will be sold in the secondary market this year, down from a previous forecast of 58,000 to the lowest level since 2003 when the outbreak of severe acute respiratory syndrome (Sars) triggered a collapse in flat sales and prices.

Weekly sales in the 35 housing estates monitored by the agency were up more than 20 per cent to 105 deals last week from a week earlier. But that is less than half the average weekly sales of 200 to 250 deals before the cooling measures were introduced.

In the new home market only 197 flats were sold from the introduction of the Residential Properties (First-hand Sales) Ordinance on April 29 to the end of May.

“Capital may leave Hong Kong following the improvement of the US economy,” Chan said. “With the impact of the cooling measures in the Hong Kong property market, property prices may drop dramatically. The government should prepare a plan to withdraw the measures.”

Centaline Property Agency founder Shih Wing-ching said property prices will continue to drop due to uncertainties over both the political and economic environments. “It will be difficult to solve the current political disputes and interest rates may rise. These factors will lead to a further fall in property prices,” he said.

Centaline managing director Louis Chan Wing-kit said that in the short term, though luxury flat prices could drop by up to 15 per cent, prices of second-hand homes valued at less than HK$5 million could rise by 10 per cent in the second half.

“The 5,000 ‘white-form applicants’ [who are eligible to buy second-hand Home Ownership Scheme flats without paying a land premium] will boost the sales of small flats. Also, under the cooling measures, first-time buyers are not affected by the new stamp duties and most of them would buy small flats,” he said.

Related articles

- Hong Kong Home Prices at Record Gap to Sales (bloomberg.com)

Indonesia Property Market About to Hit Boom Time?

Is Indonesia Property Market About to Hit Boom Time?

Indonesia’s residential property price index (based on 14 cities) rose by 7.4 percent (2.04% adjusted for inflation) during the year to end Q1 2013, according to figures from Bank Indonesia.

Residential property sales volume rose by 26.68 percent in the fourth quarter of 2012. Sales mainly rose in small houses following the increase on subsidized housing loans for low-income people.

Residential property prices in Indonesia also accelerated for all property types.

Why the increase in activity in the property market? There has been economic growth since 2009 to 6.2 percent in 2012 and growth is expected to continue in 2013.

But not everyone can buy property in Indonesia. In fact it’s almost impossible for expats to buy freehold. They can, however, buy leasehold for upto 70 years. Read ‘An overview of the legislation involved in property transactions within Indonesia’ to find out more.

by AngloINFO World editor. Find out more about AngloINFO World editor here.

Asia Pacific Property Investments Up 50 Percent

Real Estate News | Asia Pacific Commercial News

Asia Pacific Property Investments Up 50 Percent

By Francys Vallecillo | June 11, 2013 10:51 AM ET

The investment volumes increased in both core and emerging markets and were 22.9 percent higher than a year ago, the firm reports.

Total investments for the first quarter more than doubled in core markets from the previous quarter but were only seven percent higher than last year. In emerging markets, however, investments, mostly driven by development land sales, totaled $22.6 billion, more than a 20 percent higher than last quarter and 30 percent higher than a year ago, the firm reports.

“The outlook for China, especially in the core market of Shanghai is positive with investors looking at office and retail assets,” John Stinson, managing director, Asia Pacific Capital Markets at C&W, said in the release. “In the emerging markets space, Southeast Asia continues to be favorable, with strong economic growth prospects and government investment programs as well as committed measures at structural reforms.”

Cross border investments totaled 7.6 percent during the quarter, a decrease from 12.9 percent the previous quarter.

However, Malaysia has already surpassed its foreign inflow annual total for each of the last four years. The Iskandar region reported $630.0 million or 95.7 percent of investments for the country, C&W reports.

Asian Middle Class Takes Centre Stage

Asian Middle Class Takes Centre Stage News Posted On: 10 June 2013

http://www.property-abroad.com/malaysia/news-story/asian-middle-class-takes-centre-stage-19317720/

Asia’s booming economies have lifted millions of families into a new middle class, with new aspirations and opportunities. Across Asia these newly prosperous people are turning to property investment and many are interested in overseas investments, seeing them as a lucrative and safe place for their money.

As a result, the real estate investment industry is at a tipping point in its source of capital; the Asia-Pacific middle classes are set to outstrip the Americas and Europe by 2030. John Forbes, of Price Waterhouse Coopers, wrote in Investment Property Forum’s Focus magazine that the number of investors from the Asia-Pacific region would surge sixfold in the next seventeen years, to over 3bn people. By 2020, more than half the world’s middle class is expected to reside in Asia, compared with one fourth in 2009, according to Brookings Institute economist Homi Kharas.

The IMF pointed out in its World Economic Outlook, published in April of last year, that developing economies overtook developed nations in global GDP last year, and this development was led by the so-called BRIC group: http://www.property-abroad.com/brazil/search/Brazil, Russia, India and China. Mr. Forbes pointed to this as additional evidence that the world is at a tipping point in terms of distribution of the middle classes worldwide, and that the tipping point in urbanization has already been passed.

On his website, Mr. Forbes states his opinion that ‘by 2015 the middle classes in Asia will equal those in Europe and the middle classes in the developing world will equal those in the advanced economies. The 5 years after that will see a dramatic growth in the middle classes of Asia.’

The new Asian middle classes, according to Mr. Forbes, will not only want to spend in shops and consume goods and services, demand for which is already driving demand for office space worldwide but especially in Asia. Demand for investment opportunities is also likely to rise and as it does, the real estate industry will increasingly become a medium through which Asians buy European and North American real estate.

While this process has only just begun to really bite, it’s being prefigured by a rise in the number of loans across Asia as newly middle-class Asians strive for a better lifestyle and banks seek ways to diversify out of the Western economic doldrums. While there are concerns that a debt problem may be emerging, most signs seem to indicate that canny borrowing and economic upswing together will keep most of Asia out of trouble. However, while overall debt burdens are lower in Asia than in the West, judged against income they are up to 30% higher.

One key indicator that Mr. Forbes’ predictions of a rising Eastern middle class may be accurate is the market for cars and motorbikes. Cars especially are a traditional middle class status symbol and between 2007 and 2012, car and motorbike loans in Asia outside Japan nearly doubled, even as consumer electronics loans more than doubled. It remains to be seen whether the trend that has been observed in China will hold good across the rapidly developing Asia-Pacific region, but in 2012 Chinese overseas direct investment in Europe shot up by 21% on the previous year. If the rest of Asia follows suit the shape of the real estate market in Europe could be decided in the suburbs of Shanghai, Kuala Lumpur and Manila.

Written by Les Calvert

Related articles

- Coming to terms with the Asian century (eastasiaforum.org)

Malaysia – Iskandar follows the Shenzhen script

Iskandar follows the Shenzhen script

http://www.scmp.com/business/money/markets-investing/article/1257278/iskandar-follows-shenzhen-script

Links to Hong Kong are replicated in the Malaysian economic zone’s ties to Singapore

Efforts to transform the Malaysian border zone near Singapore into a bustling commercial corridor appear to be on track after a rocky start.

The zone, known as Iskandar, is emerging as an attractive opportunity that deserves to be on the radar of those considering investment in the new growth centres of Asia.

Iskandar is a 2,216 square kilometre urbanisation project, three times the size of Singapore. Nusajaya, the residential zone at its core, which stares across the water at the Singapore skyline, is just a 45-minute drive from Singapore’s Changi airport. The zone is geared towards a residential metropolis with educational, medical and theme-park infrastructures being used to attract resident migrants from Singapore. Logistics, transport and industrial-related infrastructure is being developed in adjacent zones.

Iskandar is a 2,216 square kilometre urbanisation project, three times the size of Singapore. Nusajaya, the residential zone at its core, which stares across the water at the Singapore skyline, is just a 45-minute drive from Singapore’s Changi airport. The zone is geared towards a residential metropolis with educational, medical and theme-park infrastructures being used to attract resident migrants from Singapore. Logistics, transport and industrial-related infrastructure is being developed in adjacent zones.

One reason that Iskandar makes investment sense is that it complements Singapore’s new economic strategy. The city state’s sharp rise in housing prices and schooling costs is creating a natural pool of demand for low-cost living within commuting distance. This pool also includes the growing ranks of Singaporean pensioners struggling to survive in a low-yield and high-inflation environment. Iskandar’s new industrial parks offer the lure of cheap labour, good logistics and infrastructure. For Malaysia, it offers the possibility of regenerating the neighbouring border city of Johor Bahru, improving cross-border connectivity and bringing in cross-border investment in a golden era of Malaysian-Singaporean relations.

Malaysian planners borrowed heavily from China’s experience in fostering rapid industrialisation of the Pearl River Delta economic zone. Authorities in Kuala Lumpur identified the Johor border zone in 2006 as one of Malaysia’s five special economic corridors, reminiscent of the way Shenzhen was singled out as one of China’s five special economic zones in 1979.

However, it has only been since 2011, when Singapore’s sovereign fund Temasek announced a 30 billion Malaysian ringgit (HK$6.33 billion) joint investment with its Malaysian counterpart Khazanah that overseas investors started taking Iskandar seriously.

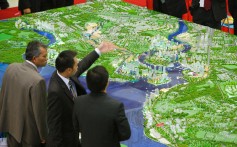

Businessmen have closely followed the plans for Iskandar as it broadens its appeal to investors. Photo: Bloomberg

For overseas investors, the key attraction of Nusajaya’s residential real estate is low prices. Malaysia remains the only market in Asia outside Hong Kong and Singapore to allow foreigners to own freehold property without restrictions. Consider also that Singaporean property prices have risen by close to 50 per cent during the past five years and have been the target of numerous government measures to restrain further price appreciation. Keep in mind that average property prices in Singapore are 3.7 times more expensive than Nusajaya’s. Much like Shenzhen over a decade ago, it is this cross-border price arbitrage that will continue to fuel strong home-price appreciation in Iskandar. Indeed, with prices already at 750 Malaysian ringgit per square foot, Iskandar property is comparable with prices in the capital Kuala Lumpur. That said, cross-border connectivity plans are likely to be a catalyst for future gains in land prices.

Currently, there is one coastal highway connecting Singapore to Nusajaya across the Johor strait at two gateways: the Causeway and the Second Link. A new ferry link between Singapore and Puteri Harbour, Nusajaya, began service in May. Future plans include an MRT link to Singapore’s MRT system and a high-speed rail service from Kuala Lumpur to Johor Bahru which will connect to central Singapore.

Iskandar’s success in attracting big-brand investors, especially from Britain, has been surprising and possibly reflects strong government involvement. The Legoland theme park, which opened in September last year, attracted 1 million visitors in just four months. It has since had to introduce admission caps to cope with the flood of daily visitors. The Hello Kitty Town park opened one month later has also enjoyed strong visitor growth.

More surprising has been the success of Educity, a campus of schools and colleges which has filled up so fast that authorities have decided to develop an adjacent Education Park. Southampton University and Newcastle University have both opened faculties and currently have several hundred students enrolled

Britain’s Marlborough College has also established an integrated primary and secondary boarding school in Educity. About 370 students, many commuting daily from Singapore, are currently enrolled. Other high-profile brands soon to open include Singapore’s highly-regarded Gleneagles Hospital, which will open a 300-bed medical centre by next year.

The “build it and they will come” model of investment has yielded impressive results both in Singapore and in markets such as Macau. The synergies between Iskandar and Singapore, including joint government financial commitment to ensure its success, add up to a good long-term investment for those looking to relive the heyday and investment returns of Hong Kong’s economic integration with Shenzhen.

Carl Berrisford is an analyst for UBS CIO Wealth Management

Related articles

- More snapping up homes in Iskandar M’sia (iskandarmalaysiaproperties.wordpress.com)

Thailand – Some interesting discussion

Some interesting discussion

If I buy a property in my Thai partner’s name is there any legal contact that we can sign that gives me some control over if and when the property is sold?

I guess lawyers will always be able to write a legal document but will it hold up in a court of law…?

Thank You for any advice…

Read More

http://www.thaivisa.com/forum/topic/645580-buying-chanote-land-and-house-in-thai-partners-name/

An artist’s impression of Afiniti Residences in Medini Iskandar Malaysia. (Photo: Afiniti)

An artist’s impression of Afiniti Residences in Medini Iskandar Malaysia. (Photo: Afiniti)